Content

When it comes to invoicing, you are likely aware that the invoicing process is just not limited to sending invoices to your clients. Writing clear invoices that are easy to understand may help reduce the risk of an invoice being past due. Offering a variety of payment options may also help reduce past-due invoices. For example, What Is An Invoice? What Is It Used For? business owners may consider using pay-enabled invoices that allow customers to pay their bills right from the online invoice. When selling products or services, enter the invoice amount owed as accounts payable on the buyer’s end. Typically, a business sends an invoice to a client after they deliver the product or service.

- Interim invoices are sent periodically through a project, typically in alignment with pre-agreed-upon milestones.

- Further implementations are underway in the Scandinavian countries as result of the North European Subset project.

- A receipt is issued as proof of payment after payment has been received, whereas a bill represents outstanding charges that must be paid immediately.

- There UBL procurement documents are implemented between various European countries.

- This blog outlines everything you need to know to start invoicing your customers.

If you use Square Invoices, you can filter and view invoices in your Square Dashboard online or the Square Point of Sale app. Invoicing software makes it easy for businesses to create and send invoices. With online invoice templates, a business can invoice a client in a matter of seconds, without needing to repopulate the same information each time.

Sales Invoices vs. Bills

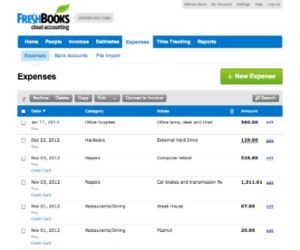

You don’t have to offer the same payment terms to each customer, FreshBooks advises. You can make some invoices due and payable on receipt, or 10, 15, 30, 60 or 90 days after delivery. If you’re going to allow customers to buy on credit, have the customer fill out a credit application. If you’re applying for a business account with a supplier, you probably need to let your supplier check your credit history, most recent bank statement, or another financial document.

If this is the case, the statement must indicate that no subsequent invoices will be sent. One simplest, most straightforward way to confirm an invoice is by obtaining the buyer’s signature. The customer is saying they accept the invoice by putting down a signature. Including this information is standard procedure on all invoices and is especially important for any customers who want to claim back any VAT that has been charged.

Set Automatic Invoice Reminders

In a nutshell, an invoice concisely states the payment amount due, payment instructions, terms, and due date. For example, if you provide marketing services as a freelancer, you would send an invoice https://quick-bookkeeping.net/ to the client to receive payment after completing your services. Or, if you outsourced marketing services for your business, you would be on the receiving end of an invoice to make payment.